December 2023 at a glance

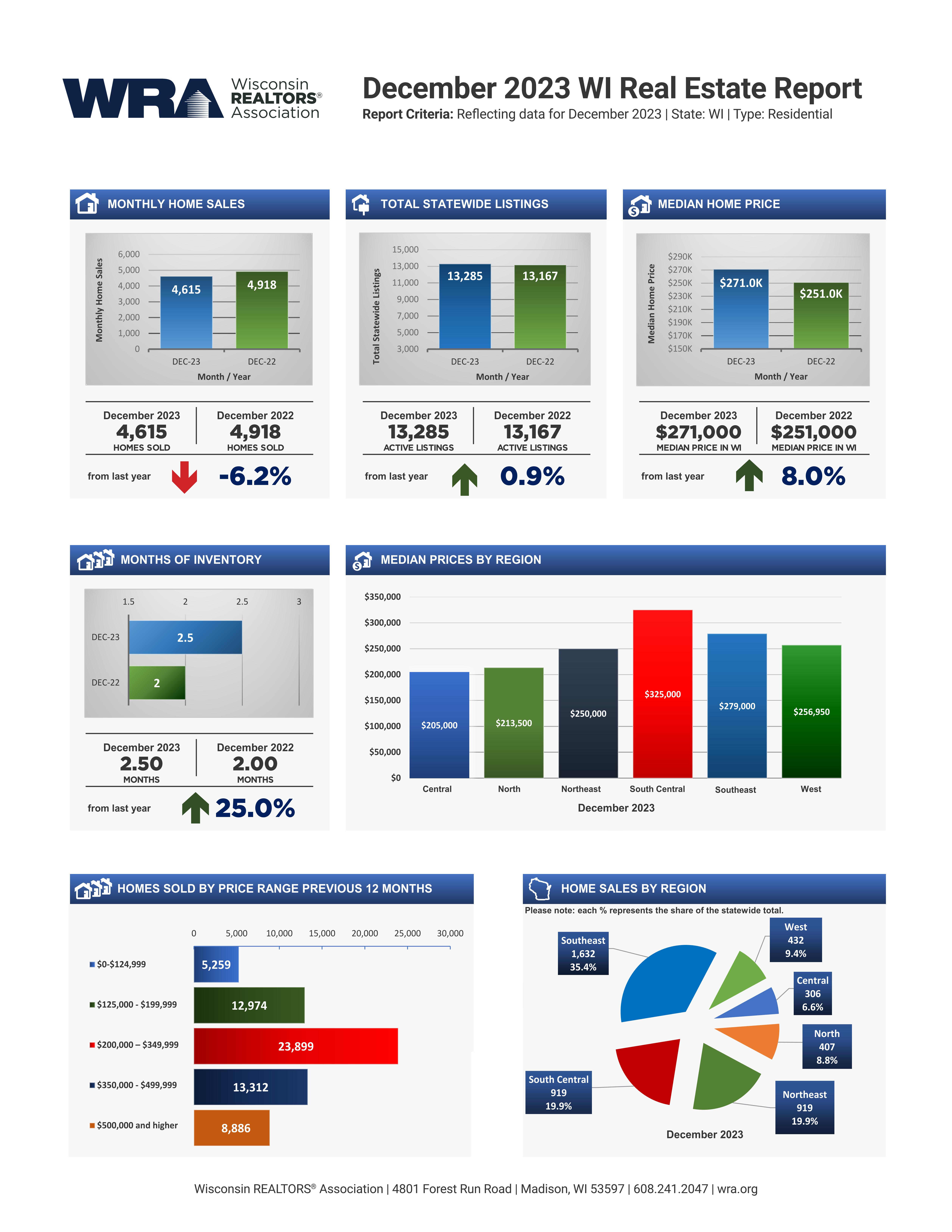

- New listings of Wisconsin existing homes rose 6.3% in December, compared to that same month in 2022, and this led to an increase in total listings of 0.9% over that same period.

- Although the months of available supply did improve 25% over the last 12 months, the market continued to show a seller’s advantage with just 2.5 months of supply in December. This is well below the benchmark of six months that indicates a balanced market.

- The limited supply of homes on the market kept December sales down 6.2% relative to December 2022. Still, fourth quarter sales performed better than the first three quarters of the year. Sales in the fourth quarter of 2023 were just 4.3% below the fourth quarter of 2022, whereas the first nine months of 2023 trailed that same period in 2022 by 21.1%.

- Total existing home sales for 2023 were 17.5% lower than sales in 2022.

- The weak inventory levels in December pushed the median price up to $271,000, which is an increase of 8% relative to December 2022. Similarly, the median price for all of 2023 was 7.5% higher than the 2022 median price.

- Mortgage rates experienced improvement for the second straight month. The average 30-year fixed-rate mortgage was 7.62% in October, 7.44% in November and 6.82% in December. The December 2023 rate was about a half percent higher than the rate in December 2022.

- The annual increase in mortgage rates and home prices have hurt affordability, with the Wisconsin Housing Affordability Index falling 9.7% between December 2022 and December 2023.

Analysis from the experts

Winter offers opportunities for buyers

"For the third straight month, new listings have increased year over year, and now total listings are also up slightly. Although this is still a strong seller’s market, there are opportunities for buyers during the winter season since there is less competition, and sellers who list their homes during the winter are often more highly motivated to sell.”

Mary Jo Bowe, 2024 Chair of the Board of Directors, Wisconsin REALTORS® Association

Continued progress on mortgage rates improves affordability

"It was good to see the 30-year fixed mortgage rate fall below 7%, and while affordability is lower than it was in December 2022, it has improved by about 13% since hitting bottom in August and September 2023. We look forward to continued improvement in mortgage rates in 2024."

Tom Larson, President & CEO, Wisconsin REALTORS® Association

Is the Fed ready to cut short-term interest rates?

"In its December meeting, the Federal Open Market Committee, which is the Fed committee that sets short-term interest rate targets, lowered its inflation projections for 2024 and decided to keep rates steady. The committee also signaled that it’s likely to cut the Federal Funds Rate by 75 basis points in 2024. The Fed is clearly less concerned about overheating the economy and thereby fueling inflation, which is positive news. Hopefully these lower inflationary expectations also lead to further improvement in mortgage rates in 2024."

Dave Clark, Professor Emeritus of Economics and WRA Consultant