October 2024 at a glance

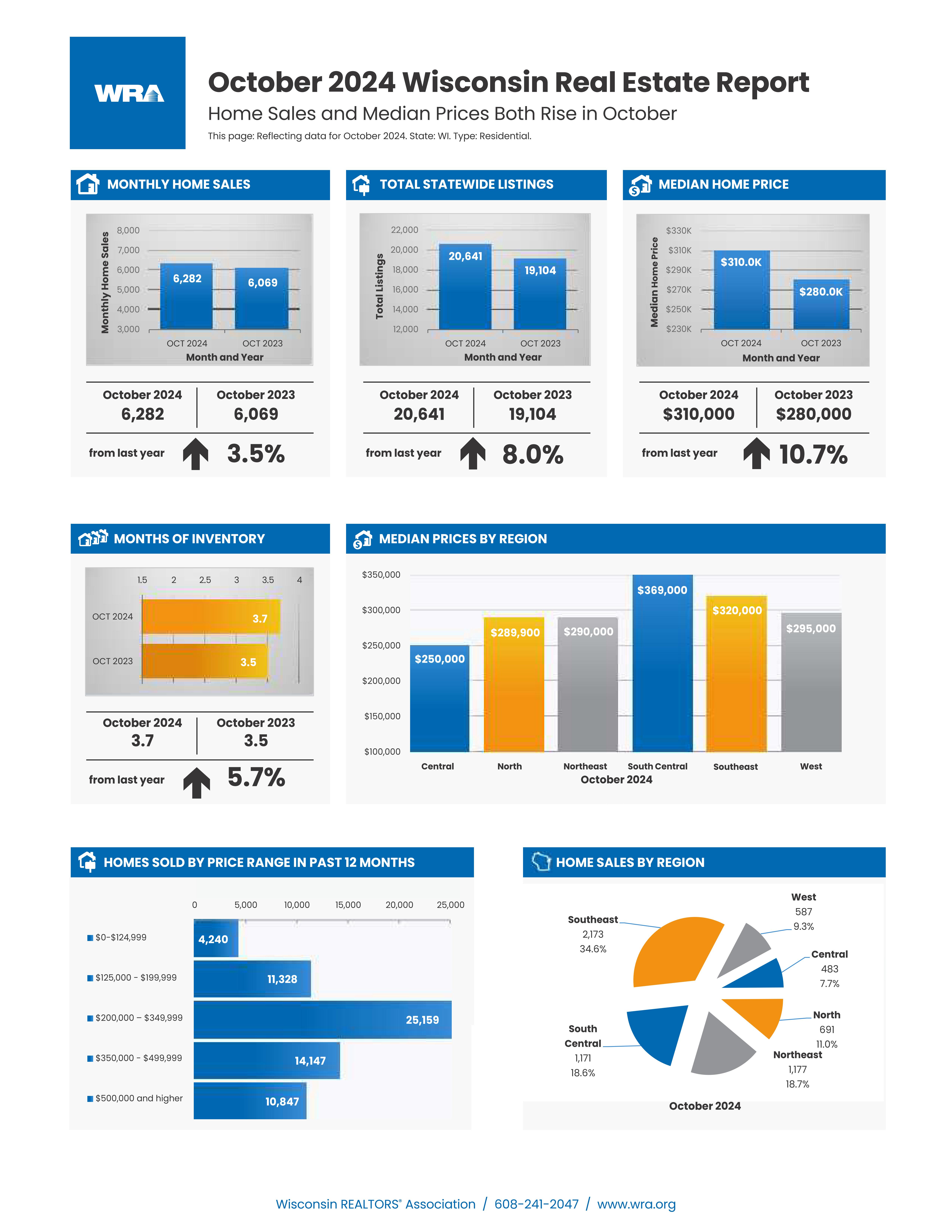

- October home sales rebounded after falling in September. Compared to October 2023, existing home sales rose 3.5%. Strong demand and tight supply continued to put upward pressure on the median price, which rose 10.7% to $310,000 over that same 12-month period. On a year-to-date basis, closed sales rose 4.1% relative to the first 10 months of 2023, and the median price rose 8% to $310,000.

- Inventories have improved due in part to the spike in listings recorded in October. New listings rose 8.6% compared to a year earlier, which pushed total listings up 8% over October 2023.

- Inventories improved across all urban-rural classifications, but they remain tightest in the state’s metropolitan counties, which had just 3.4 months of supply in October. In contrast, micropolitan counties, which include smaller cities and towns, had 4.2 months of supply, and counties classified as rural had 4.9 months of supply.

- The state remains a seller’s market and would have needed 12,720 additional listings in October to reach a balanced market characterized by six months of supply.

- After falling 88 basis points between May and September, the average 30-year fixed-rate mortgage reversed course and increased a quarter percent in October to 6.43%. Still, mortgage rates are more than a percent lower than October 2023 when the average rate was 7.62%.

- Although mortgage rates did improve over the last 12 months, the spike in median prices and the tepid growth in median family income over the last year led to very little improvement in affordability. The Wisconsin Housing Affordability Index rose just 1.6% since October 2023.

Additional analysis

Mortgage Rate Concerns

“It’s good to see mortgage rates below the peak from a year ago, but it was disappointing to see them rise a quarter point in October. Unfortunately, spikes in mortgage rates keep both buyers and sellers of existing homes sidelined.”

Mary Jo Bowe, 2024 Chair of the Board of Directors, Wisconsin REALTORS® Association

Inventory Improvements

“We’ve had consistent improvement in our listings beginning in November of last year, and the uptick in both new listings and total listings in October was a good sign. Although months of inventory are tightest in our large cities, they are getting closer to being balanced in Wisconsin’s smaller urban areas and rural communities.”

Tom Larson, President & CEO, Wisconsin REALTORS® Association

Explaining Recent Mortgage Rate Increases

“Although the Fed has now lowered the short-term Federal Funds rate by 75 basis points, the 30-year fixed-rate mortgage moved in the opposite direction in October. Mortgages tend to track the 10-year Treasury yield more closely than short-term interest rates, and those Treasury yields have been increasing since mid-September. Uncertainty about future economic growth can contribute to changes in the Treasury yield. Now that the national elections have been settled, hopefully this leads to less uncertainty, lower Treasury yields and lower mortgage rates.”

Dave Clark, Professor Emeritus of Economics and WRA Consultant