September 2023 at a glance

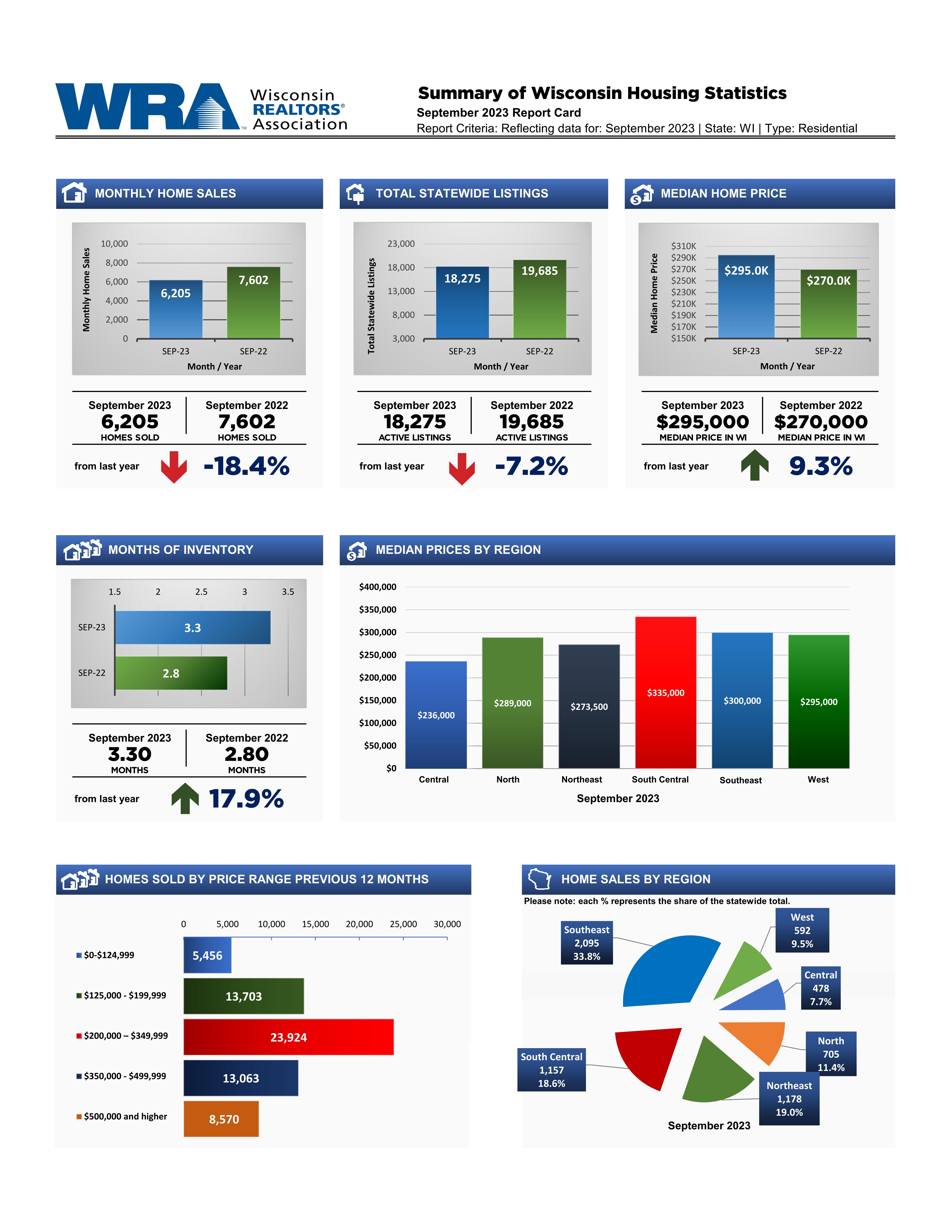

- The Wisconsin market for existing homes remains a strong seller’s market, which hampered home sales and drove up median prices over the last 12 months. Home sales dropped 18.4% between September 2022 and September 2023, and median prices rose 9.3% to $295,000 over that same period.

- Through the first three quarters of 2023, sales of existing homes fell 21.7% relative to the first nine months of 2022, and the median price rose to $289,000, which represents a 9.1% increase over the same nine-month period last year

- Mortgage rates averaged 7.20% in September 2023, which is more than a percentage point higher than this time last year when the rate stood at 6.11%. It is more than twice the rate of September 2021 when rates were just 2.90%

- The increase in mortgage rates has affected both the demand and supply sides of the market. Current owners, many of whom refinanced during the period of low mortgage rates, are reluctant to list their homes since that means financing a new purchase at much higher rates. Likewise, some buyers have pulled out of the market given the higher cost of financing. These higher rates are particularly challenging for first-time buyers who rely more heavily on financing to purchase a home.

- Overall, supply remains very tight. With just 3.3 months of supply in September, the state remains well short of a balanced market that is characterized by six months of supply. With only 18,275 total listings in September, we would need a 77% increase in listings to get back to a balanced market.

- Affordability continues to suffer. The Wisconsin Housing Affordability Index measures the percent of the median-priced home that a buyer with median family income would qualify to purchase assuming a 20% down payment and a 30-year fixed-mortgage at current rates financing the remainder of the balance. The index held at 123 for the second straight month, which is its lowest point since the WRA began tracking the index in 2009. This is a 14.6% decline from last year when the index stood at 144.

Analysis from the experts

Listing pictures shows promise

“For the second straight month, the annual decline in new listings has been below 4%, which is a significant improvement from earlier trends where the decline was much larger. Now we’re starting to see promising signs for total listings as well, which had the lowest annual reduction in total listings in nearly two years. Hopefully these supply trends continue.”

Joe Horning, 2023 Chairman of the Board of Directors, Wisconsin REALTORS® Association

Unmet demand persists despite higher mortgage rates

“Mortgage rates are at their highest point since late 2000, which priced a lot of first-time buyers out of the market for now. This means our available supply goes further, which is why our months of inventory have improved slightly. But we still have a long way to go before millennial demand is met and the housing market becomes balanced.”

Michael Theo, President & CEO, Wisconsin REALTORS® Association

Significant housing price correction unlikely

“The Great Recession brought a significant home price correction as the housing bubble burst and foreclosures spiked. We’re in a much different situation now. Although rising home prices and rising mortgage rates have pushed affordability to record-low levels, there is very little chance we will see a similar price correction in this market. Current owners are well positioned to weather an economic downturn given the mortgage rates they locked in, and strong demand from millennials will keep housing prices from falling like they did after that recession.”

Dave Clark, Professor Emeritus of Economics and WRA Consultant